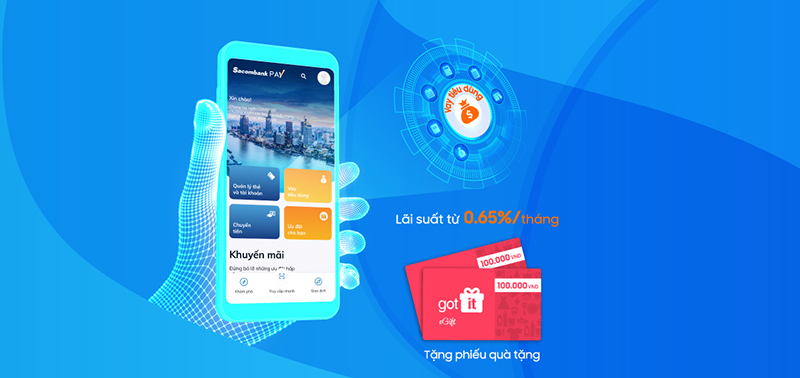

Receive Got It gift voucher when taking a consumer loan on Sacombank Pay app

08/04/2020

Consumer loan is one of the outstanding features of Sacombank Pay application. Customers can borrow when meeting the following conditions: owning personal credit cards or savings books and payment cards at Sacombank. After successfully making a loan on the application, the loan will be disbursed to the Sacombank Pay account. The minimum loan amount is 6, 12 and 24 million dong respectively for 6, 12 and 24 monthly instalment terms with an interest rate of 0.65%/month for customers borrowing using savings books and 0.84 %/month for customers borrowing using credit cards; can borrow up to 90% of credit card limit or loan rate according to savings book and up to VND100 million. Loans are managed and paid/received final settlement directly on Sacombank Pay.

Sacombank Pay is a financial management application, fully integrated with modern banking features and utilities to bring customers many interesting experiences in digital banking. Customers can easily download the Sacombank Pay application for free from the App Store or Google Play to their phones. After successfully downloading the application, customers only need to register with their phone number, then perform the operation of verifying personal information or card information right on the application to be able to use all features and utilities. Sacombank Pay's benefits such as: Easy to top up/transfer money into the app; withdraw cash at ATM systems without using plastic cards; experience modern payment technology by scanning QR codes; actively manage cards and accounts; flexibly make bill division; securely pay bills of different fields; enjoy ample facilities…

For detailed information, customers please kindly contact Hotline 1900 5555 88 or 028 3526 6060; access to website khuyenmai.sacombank.com and register for card online at website dangkythe.sacombank.com