“Paving the way for the future”: Sacombank supports the development of green, smart transportation

29/04/2025

METRO LINE 1: OPEN-LOOP PAYMENT TECHNOLOGY AND SACOMBANK’S CONTRIBUTION

What is the significance of Sacombank’s collaboration with HCMC Urban Railway No. 1 Company (HURC1), card organizations, and technology companies to deploy the open-loop electronic ticketing system for Metro Line 1 (Ben Thanh – Suoi Tien), and what does it mean for public transportation in HCMC and Vietnam as a whole?

The open-loop public transportation payment model has gained significant traction globally, especially in the post-COVID-19 era, as cashless payments have become an inevitable trend. This system allows passengers to use various payment methods - such as bank cards, Apple Pay, Google Pay, citizen ID cards, or QR code scanning via mobile phones and smartwatches - to pass through ticket gates, eliminating the need for traditional paper tickets.

HCMC’s decision to adopt open-loop technology for Metro Line 1 from the outset reflects a forward-thinking strategy, aligning the city with global smart transportation trends. This solution not only enhances the travel experience for residents but also establishes HCMC as a modern, globally integrated metropolis.

What specific role does Sacombank play in the payment process for Metro Line 1’s electronic ticketing system, and can you share more about the implementation process with partners?

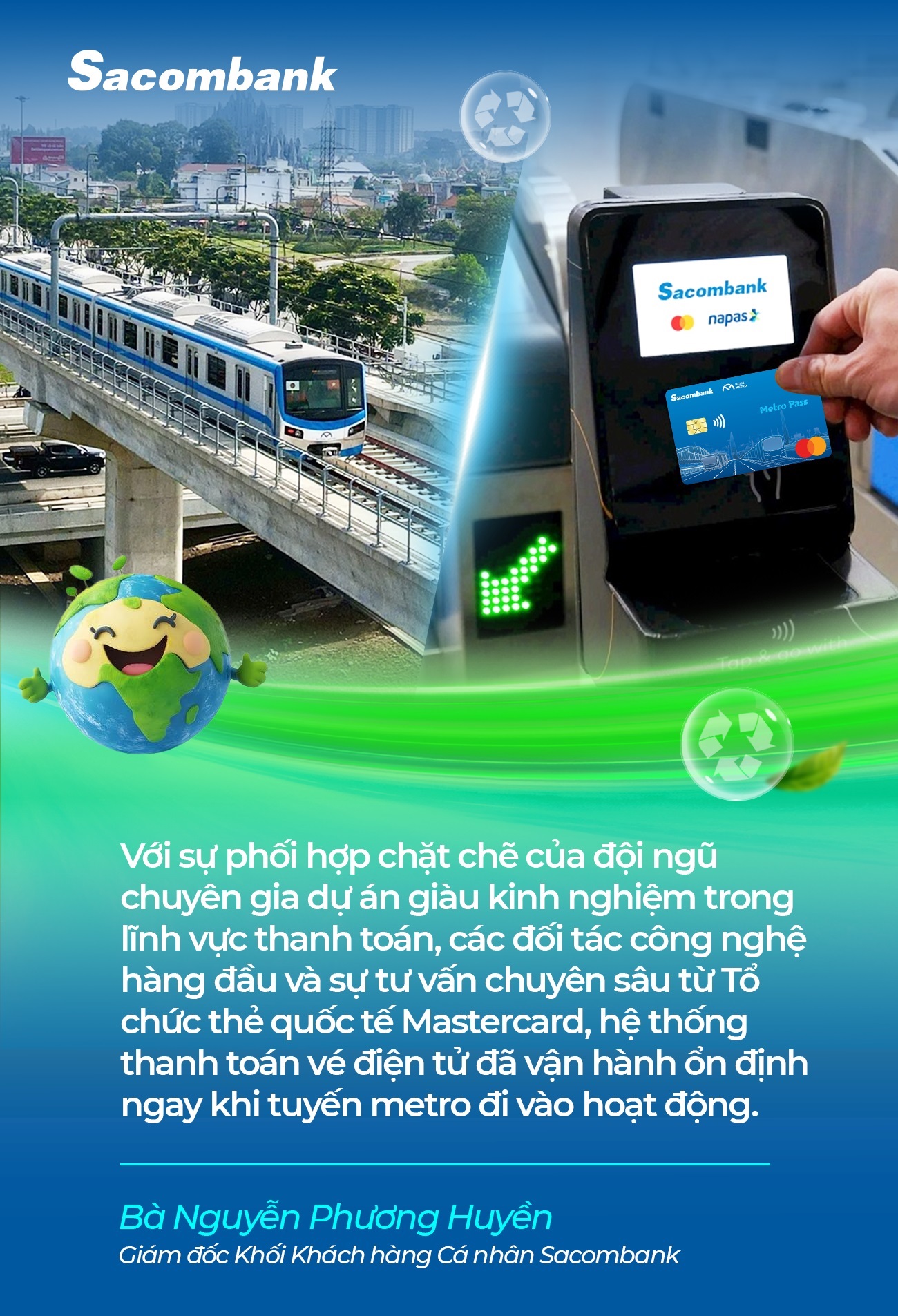

We provide payment acceptance services by integrating card readers into the ticket gate system and developing transaction processing and reconciliation flows between card-issuing banks and card organizations such as Mastercard, Visa, JCB, UnionPay, American Express, and Napas. This system ensures fast transaction processing while adhering to the highest security standards, enabling passengers to use bank cards, mobile phones, or smartwatches safely when using public transportation.

Though the project had been in development for a long time, its focused implementation took only about three months before launch. Thanks to the close collaboration of experienced payment project experts, leading technology partners, and in-depth consultation from Mastercard, the electronic ticketing system operated seamlessly from the moment Metro Line 1 commenced operations.

Beyond user convenience, what advantages does the electronic ticketing system offer to management and operational agencies like HURC1?

The system provides significant benefits for management and operations. First, it enhances financial transparency, reduces revenue leakage risks, and minimizes errors associated with manual cash handling. Automated transaction reconciliation saves substantial time and resources compared to traditional methods.

Additionally, the system significantly reduces operational costs by decreasing the need for ticket booth staff, paper ticket printing, and maintenance of automated machines - thus improving efficiency. It also supports environmental goals by reducing paper waste and promoting green transportation.

Importantly, the system provides real-time passenger data, enabling operators to analyze travel patterns and optimize routes, service frequency, and policy planning. In this way, the electronic ticketing system is not only a convenient payment solution but also a vital tool for modernizing urban transport management.

SACOMBANK & THE VISION OF SUPPORTING GREEN, SMART TRANSPORTATION

How do you assess the current state of electronic payments in Vietnam’s transportation sector, and what role do banks - especially Sacombank - play in this digital transformation?

The digitalization of Vietnam’s transportation payments is still in its early stages and faces several challenges. While electronic toll collection (ETC) has been implemented on highways, and major cities like HCMC and Hanoi have launched cashless payment initiatives, many provinces and cities have yet to fully adopt this transformation.

To align with the government’s digital economy vision, improvements in infrastructure, system synchronization, and digital adoption are essential. Banks play a central role in connecting, advising, and supporting the deployment of digital payment solutions tailored to local contexts. With our experience, advanced technology platform, and commitment to pioneering innovation, Sacombank is ready to collaborate with provinces and cities to design and implement smart payment systems that meet local needs.

With strong support from the government, ministries, local authorities, and coordinated efforts from banks and technology companies, we believe Vietnam will soon achieve its vision for smart transportation, bringing tangible benefits to the public and society.

Following Metro Line 1, what other projects is Sacombank undertaking to support HCMC in developing green, sustainable transportation?

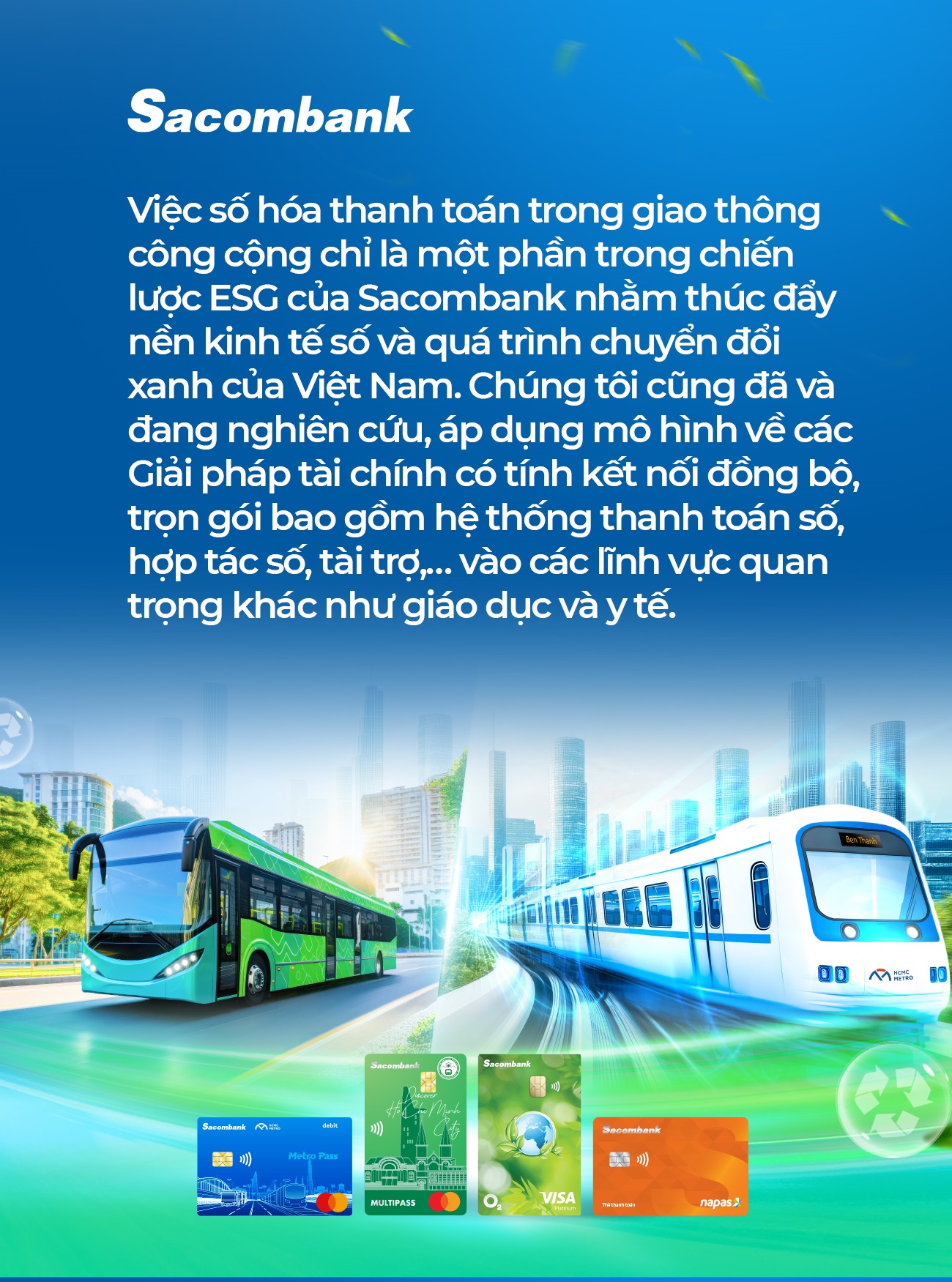

Sacombank is working with the HCMC Department of Transport and partners to deploy electronic ticketing systems for buses, river buses, and electric buggy vehicles. More than 2,200 buses across the city will be equipped with a unified payment system that allows passengers to use bank cards or digital wallets instead of paper tickets. Currently, over 510 buses have adopted the new system, with a target of 100% coverage by the end of June 2025.

This initiative paves the way for the city to build a fully connected electronic ticketing network - creating an integrated public transport “ecosystem” that ensures a seamless and convenient experience for commuters. Notably, HCMC aims to power 100% of its bus fleet with electricity or green energy by 2030, and Sacombank is committed to supporting this transition with modern digital payment solutions for sustainable urban mobility.

In tandem with infrastructure investments, Sacombank has also launched green card products to encourage public transport use and sustainable consumption:

Sacombank Mastercard Metro Pass & Sacombank Mastercard MultiPass: These cards offer customized benefits for public transport users. For instance, MultiPass holders can travel by bus for a flat rate of VND 5,000, and Metro Line 1 fares are capped at VND 10,000 - offering savings of up to 50% compared to standard fares. Additionally, a 5% discount is applied when purchasing bus ticket packages with the MultiPass, promoting eco-friendly, cost-effective, and safe travel.

Sacombank Visa Platinum O₂ & Sacombank Mastercard Debit Eco Green: These pioneering credit cards include CO₂ tracking features for each transaction, helping raise awareness of the environmental impact of spending habits. Customers who choose green products and services receive attractive cashback incentives. For every new card issued, Sacombank donates VND 10,000 to the Healthy Living Fund, a community initiative promoting sustainable lifestyles in collaboration with the Vietnam Youth Federation and the Vietnam Student Association.

Looking ahead, Sacombank will continue to research and deploy innovative digital financial solutions, partnering with authorities and residents to build a smart, modern, and environmentally friendly city.

“GREEN COMMITMENT”: SACOMBANK’S EFFORTS TO CREATE A SUSTAINABLE FUTURE

Practicing ESG, green growth, and sustainable development has become a global imperative. Does Sacombank’s promotion of cashless payment solutions in transportation align with ESG objectives?

Absolutely. At Sacombank, ESG is not just a trend - it’s a core part of our long-term development strategy. For over 33 years, we have prioritized social responsibility alongside business performance, striving for shared prosperity across the economy and society.

The financial and banking sector plays a critical role in helping businesses and communities transition toward sustainable growth. Sacombank focuses lending on green sectors such as sustainable agriculture and forestry, renewable energy, and clean industries, while offering preferential loans for individuals and enterprises involved in environmentally friendly initiatives.

Digitizing public transportation payments is one part of our broader ESG strategy to advance the digital economy and support Vietnam’s green transition. Sacombank is also developing comprehensive, integrated financial solutions - ranging from digital payment systems to financing programs in key sectors such as education and healthcare.

Through close cooperation between banks, regulators, and businesses, ESG will become a foundational value in economic and social activities - paving the way for a more sustainable future for Vietnam.

Thank you!

To commemorate the 50th anniversary of Southern Liberation Day (30/4/1975 – 30/4/2025) and celebrate a new chapter in HCMC’s public transportation journey, Sacombank is partnering with an exhibition at Ben Thanh Metro Station that showcases the city’s remarkable development. The exhibition highlights the city’s 50-year transformation and introduces smart public transport payment solutions such as the Sacombank Mastercard Metro Pass and Sacombank Mastercard MultiPass - promoting cashless transactions and an integrated transport ecosystem. In celebration, Sacombank is offering special promotions for MetroPass and MultiPass cardholders as part of the “Free Bus Rides on April 30” campaign. Specifically, from 25/04/2025 to 30/05/2025 (MetroPass), and from 11/04/2025 to 30/05/2025 (MultiPass), cardholders will receive 100% cashback on contactless fare payments for metro, buses, and other transportation within the MultiPass ecosystem. Additionally, Sacombank is offering free cards and lifetime annual fee waivers for new MetroPass and MultiPass cardholders, along with a host of shopping, dining, and travel discounts at partner merchants. |